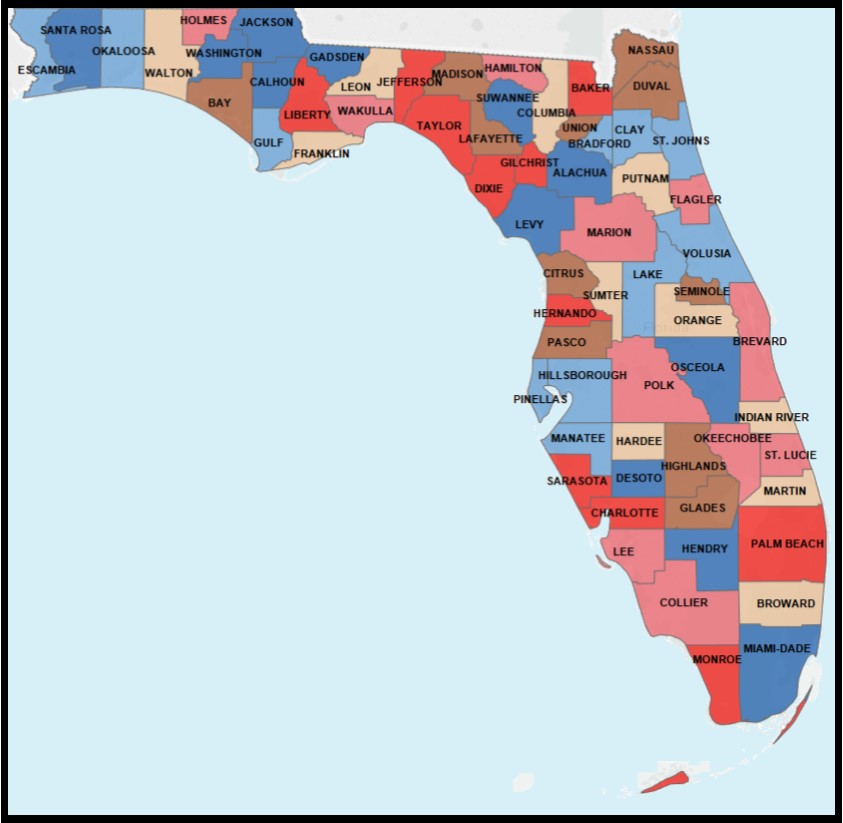

The biggest tax advantage to being a Florida resident as opposed to a non-resident who has a home in the state is Floridas real property taxes. Florida Counties With the HIGHEST Median Property Taxes.

Florida Property Taxes Explained

Property Tax These rates are assessed at the local level and can vary by county and they are based on the value of the property.

Does fl have property tax. Florida does not have an inheritance tax also called a death tax. Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year. Hillsborough 2168 Lee 2197 St.

The states average effective property tax rate is 083 which is lower than the US. As you can see Florida specifically Collier County is a great location to purchase a property. Overview of Florida taxes.

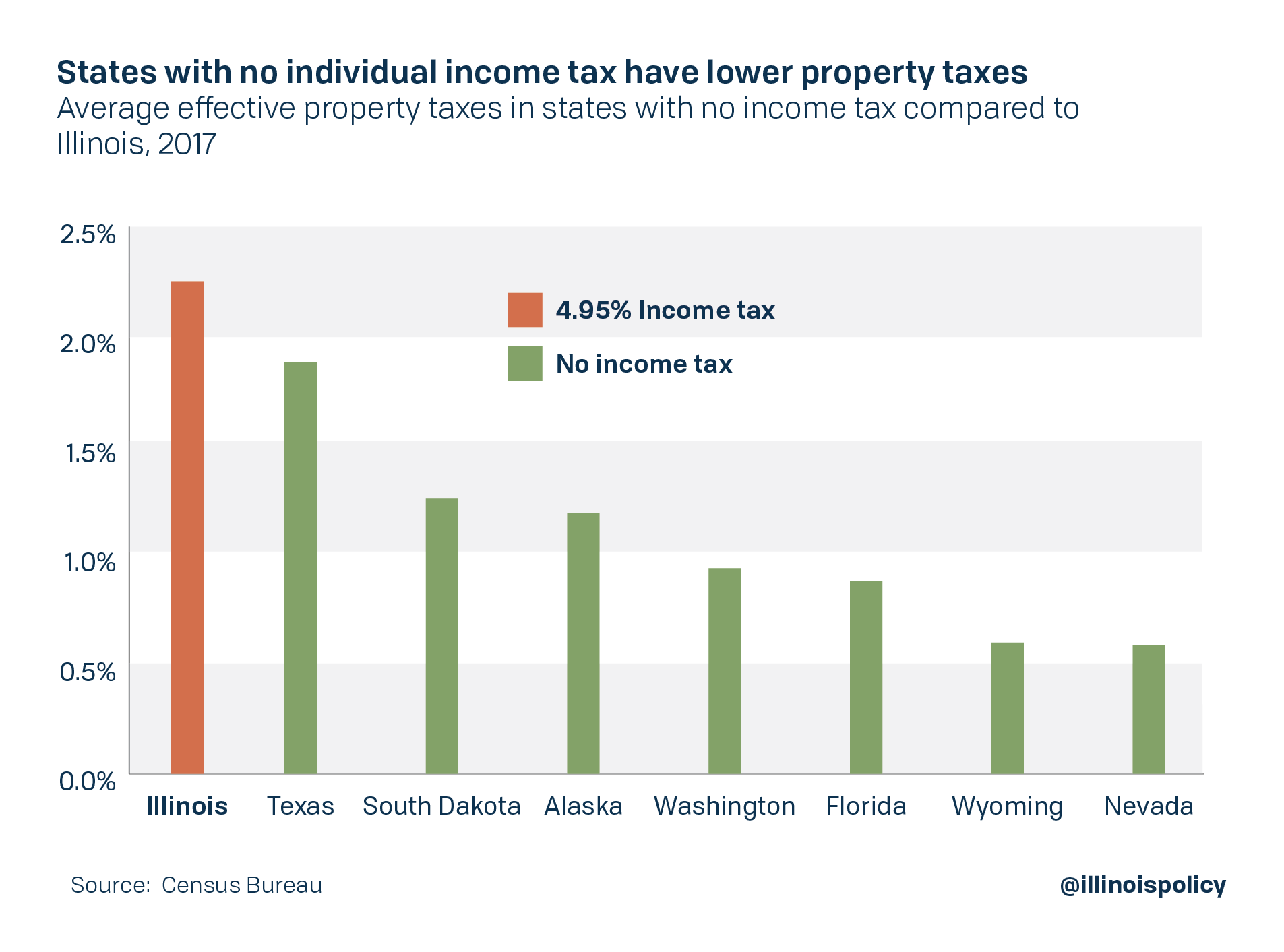

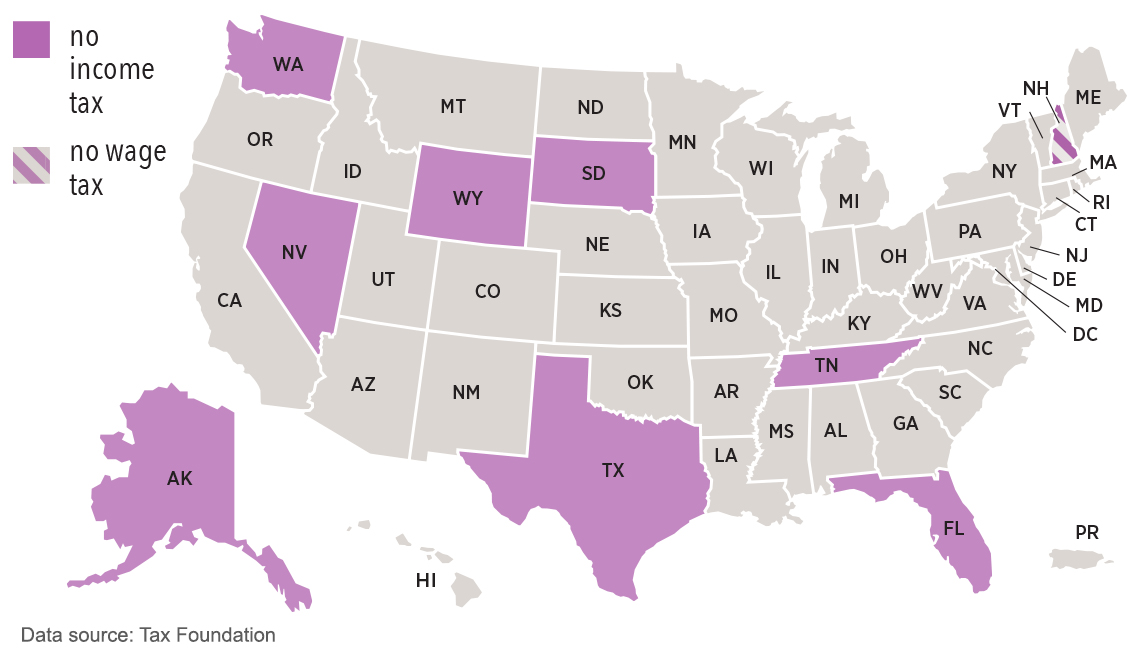

Below we have highlighted a number of tax rates ranks and measures detailing floridas income tax business tax sales tax and property tax systems. Florida is one of the states with no personal property tax at all but until 2007 the state did have an intangible personal property tax which primarily affected the. This lack of inheritance tax combined with the absence of Florida income tax makes Florida attractive for wealthy individuals wanting to reduce their tax liability.

Dixie 503 Holmes 555 Jackson 630 Hamilton 668 Washington 687 Liberty 695 Calhoun 725 Franklin 726 Levy 735 Madison 736. Information is available from the property appraisers office in the county where the applicant owns a homestead or other property. Florida authorities compute your property tax by multiplying your homes taxable value by the applicable tax rate.

27 out of 50 states even though its one of only a handful of states without a personal income tax. For tax purposes permanent residents receive a 25000 homestead reduction in the assessed value of their home which reduces their property taxes. Pick the Right Place for YOU.

Overall Florida ranks near the middle for property taxes No. You will pay sales tax where you register the vehicle. THE PROPERTY APPRAISER DOES NOT SEND TAX BILLS.

Florida residents and their heirs will not owe any estate taxes or inheritance taxes to the state of Florida. Property taxes in Florida are some of the highest in the country although there are several exemptions to try to lighten the load on some Floridians. For example imagine that the tax appraiser has placed a taxable value of 200000 on the Petersons home.

However you will still need to withhold federal income tax for those employees. Every August Florida Property Appraisers will send out their TRIM notices or Notice of Proposed Property Taxes advising all tax payers of the proposed assessment on their properties. Transfer taxes would come out to.

Florida law prohibits partial payments of delinquent real estate taxes. 370738100 x 60 222443. County property appraisers assess all real property in their counties as of January 1 each year.

In addition WalletHub looked at vehicle property taxes paid each year and Florida is one of the 24 states that dont charge any vehicle tax. This just goes to show how dramatically different Florida transfer taxes can be based solely on where the transfer of property is taking place. 100 Florida Property Tax.

A board of county commissioners or the governing. There are some laws that limit the taxes due on owner-occupied homes in Florida. Florida is ranked number twenty three out of the fifty states in order of the average amount of property taxes collected.

Property tax is generally assessed as some percentage of the propertys current value. Florida Counties With the LOWEST Median Property Taxes. If the tax rate is 1 the Petersons will owe 2000 in property tax.

If you are a full-time resident you also receive the homestead tax. Lucie 2198 Martin 2315. Does Florida Have Property Tax.

Eligibility for property tax exemptions depends on certain requirements. Education accounted for 26 percent of state expenditures in fiscal year 2015 while 317 percent went to Medicaid. Certain property tax benefits are available to persons 65 or older in Florida.

The Sunshine States average effective property tax rate is 102 slightly lower than the US. The median property tax in florida is 177300 per year for a home worth the median value of 18240000. Property taxes and property tax rates in Florida rank near or below the national average.

However the state has an effective vehicle tax rate of 26 according to a property tax report published earlier this year by WalletHub which calculated. After the local governments determine their annual budgets the county tax collector sends a tax bill to each property owner in. The tax rate is 117923.

It is crucial for land owners to critically review this Notice and determine whether the assessment is fair and accurate as the mailing of the notice commences a very short window in which a tax. The median sale price in Miami is 370738. The typical homeowner in Florida pays 2035 annually in property taxes although that amount varies greatly between counties.

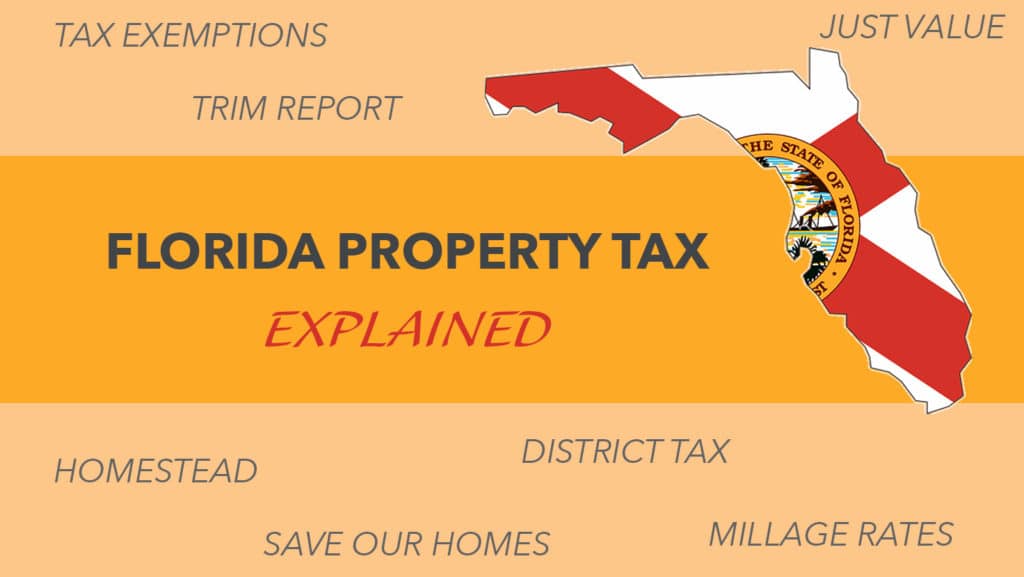

Find the property tax rates for other local agencies. Many municipalities in Florida apply the tax rate per mill or per 1K in assessed value. Alachua County for example adds a 075-percent tax to mobile home purchases on the first 5000.

In Miami-Dade County your rate is 60 cents per 100. Florida property taxes the state has created a two-tiered tax system that hit newcomers and part-time residents harder than longer-term residents. Likewise does Florida have high property tax.

These taxes are based on an assessed value of the property. Are Florida property taxes paid once a year.

How Property Taxes Keep Florida Students In Impoverished School Districts Blogs

A Guide To Your Property Tax Bill Alachua County Tax Collector

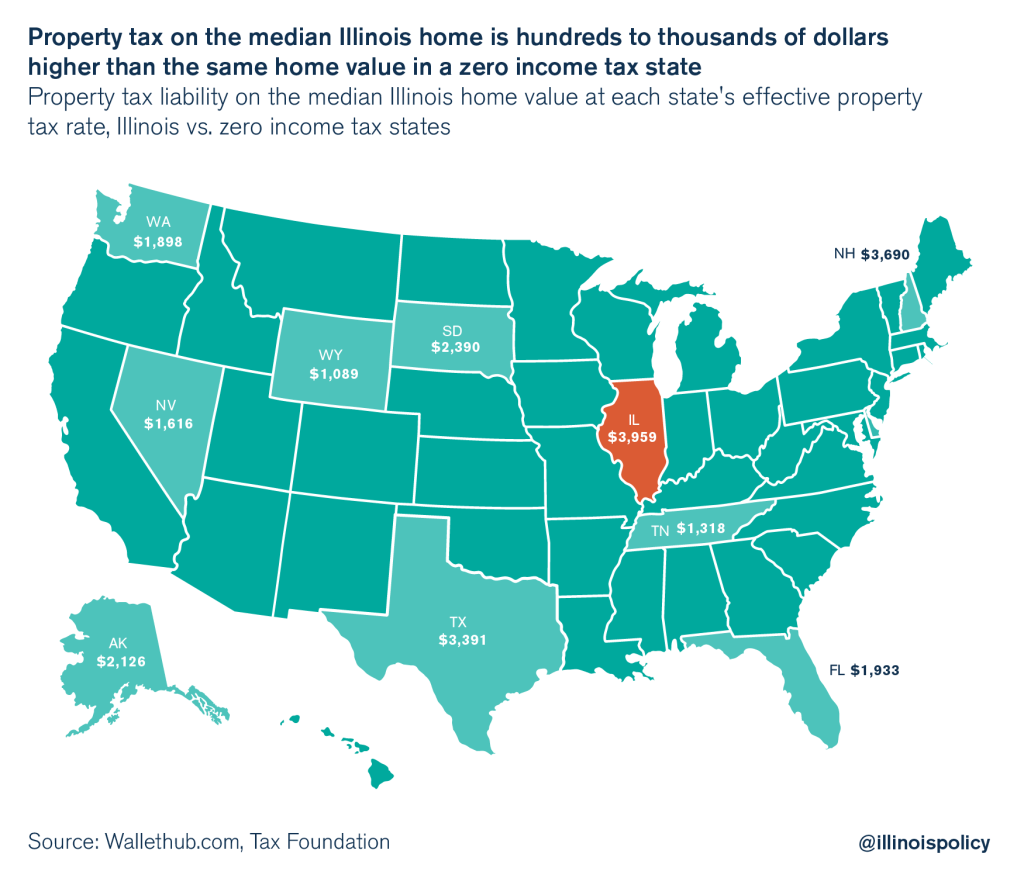

Study Illinois Property Taxes Still Second Highest In Nation

9 States That Don T Have An Income Tax

Homestead Exemption An Awesome Property Tax Break For Florida Homeowners Verobeach Com

Property Tax Breaks For Seniors In Florida Property Walls

How High Are Property Taxes In Your State Tax Foundation

Florida Dept Of Revenue Property Tax Data Portal County Profiles

/top-reasons-to-become-a-florida-resident-4d082cec2f184475a78fe99d867df9c9.png)

Top 5 Reasons To Become A Florida Resident

Illinois Has Higher Property Taxes Than Every State With No Income Tax

Property Taxes By State How High Are Property Taxes In Your State

Senate Passes Tax Bill And How Does A Property Tax Write Off Provision Affect Florida Fiscal Rangers

Florida Property Taxes Confuse Everybody

Real Estate Taxes City Of Palm Coast Florida

Florida Property Tax H R Block

Are There Any States With No Property Tax In 2021 Free Investor Guide

10 Highest And Lowest Florida County Property Taxes Florida For Boomers

:strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

States That Do Not Tax Earned Income

Post a Comment

Post a Comment